Some FNO Picks for 1st April (Fools Day). But picks are not to fool some one :)

One more thing my picks must be used in conjunction with OI readings intraday, i.e additions and unwinding of OI must be watched intraday, or if you are positional player at least confirm OI readings at EOD.

Auto stocks are doing exceptionally well as I mentioned earlier in Mondays post due to PE expansions.

Apollo Tyres:

Positions are slowly building up in the last two days in OI and with a continuation of OI building the stock can spike up in coming days. Longs can be initiated @70 with 69 as Stop Loss. Targets can be anywhere above 80.

ASHOKLEY:

Ashokleyland has a huge buildup of 56% in OI with a 3% move in price. at the peak of stock price entry is a bit risky but if price and O.I continues to rise tomorrow which is more likely than we may see a good upside in the scrip.

ESCORTS

Escorts though not a FnO stock, but as Auto sector is on a rise and stock has given a stopping volume Long positions can be initiated above 151 for a blasting move SL should be 145.

PFC

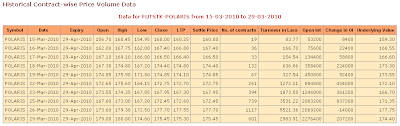

A Nice short opportunity is there in Power Finance. Good addition of OI has built up of Short Nature spot is @ 258 and Future at 2 rs premium 260. Shorts can be initiated if spot breaks 258.

Hope you loved reading it.

Happy Trading!!